Mr Michele Troni

We discovered Liquid Instruments through our involvement with the Australian National University (ANU) and our frequent co-investment with ANU Connect Ventures under leadership of Professor Mick Cardew-Hall.

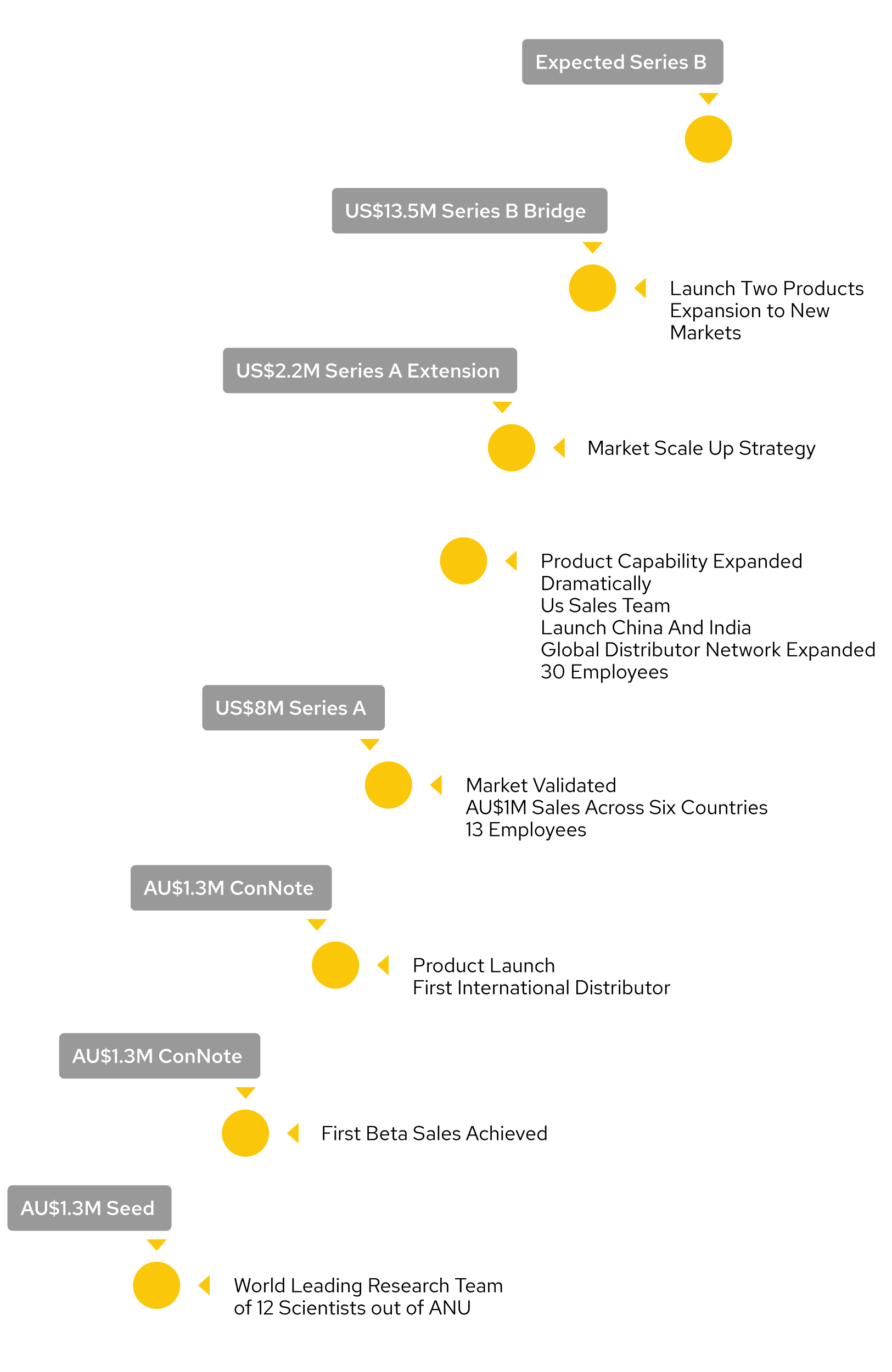

After working together for over six months, ANU Connect Venture and Hindmarsh venture capital’s fund (Canberra Business Development Fund – an equal-share fund with the ACT Government) co-invested $1.3m to fund the seed round for Liquid Instruments.

We then helped the company moving through its start-up stage, setting up as a full commercial operation, sourcing the first prototype and accelerating through the product development phase.

Following the release of a commercial product, which received strong market validation, we were able to attract a US early-stage venture capital investor, ANZU Partners, who lead a strong Series A round which saw the company become a US corporation.

We have continued to support the company’s growth path and have been delighted that with the launch of Significant, we were able to take up Series A extension in February 2020.

Liquid Instruments, the team, the product and the business, is an exceptional applied tech company with a significant growth potential. It illustrates the value that can be created by backing deep tech early and working closely alongside to grow the business to maturity”.

Mr Michele Troni